Hedge yourself against crypto market volatility and earn stable APY in all market conditions.

Start Here

Credefi connects crypto lenders with SME borrowers from the fiat economy

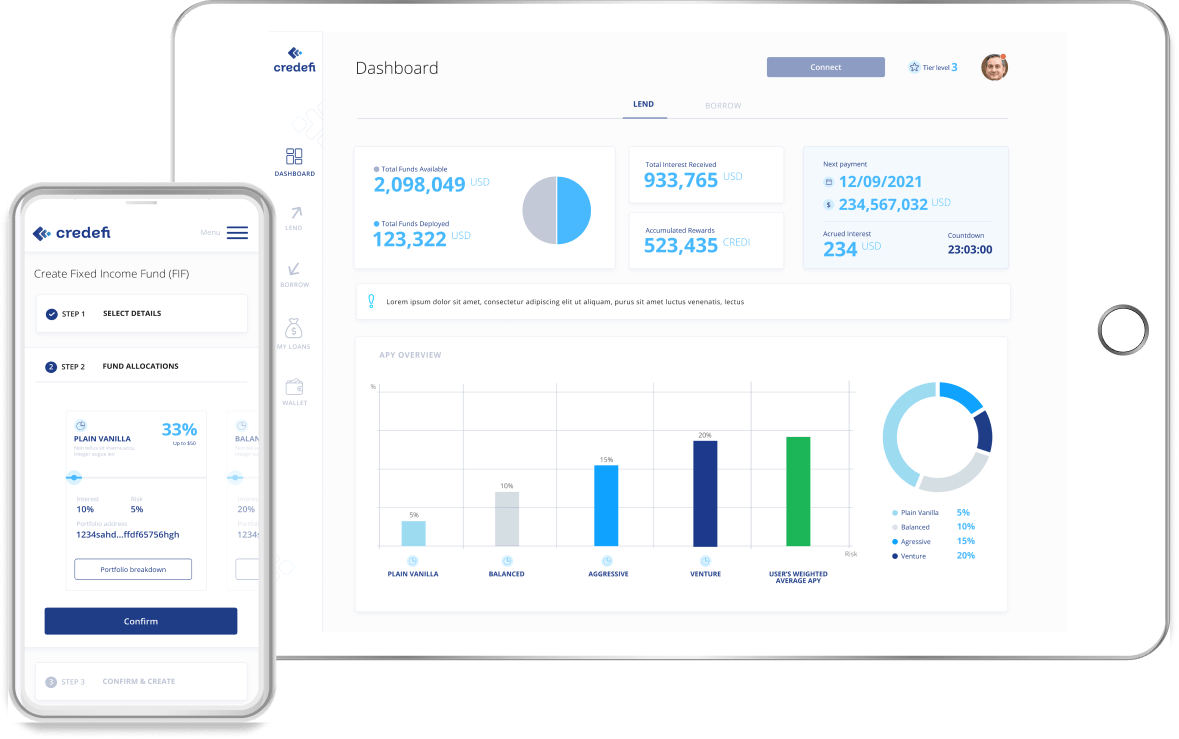

Credefi is a first mover in the DeFi space connecting crypto lenders & SME borrowers from the real economy. Our platform enables decentralized and secured lending to portfolios of businesses, protecting lenders while providing them fixed APY that is uncorrelated with crypto markets’ volatility. Credefi resolves some of the key challenges DeFi and TradFi are facing today:

DeFi yields are inconsistent, fragile, and evaporate in bear markets.

DeFi borrowers are speculative and fickle and cannot satisfy DeFi lending supply.

SMEs are historically underserved by traditional banks and are borrowing at high interest rates.

There are not enough lenders to satisfy SME borrowing demand, pushing SMEs to alternative lending solutions.

SMEs need reliable lending sources and DeFi needs reliable creditworthy borrowers, so Credefi brings them together in a win-win solution.

APY starting from 10% on your stable coins.

Start nowOur Solution

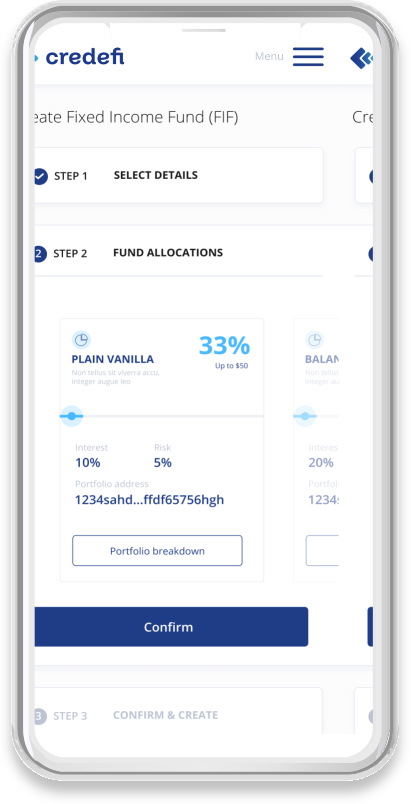

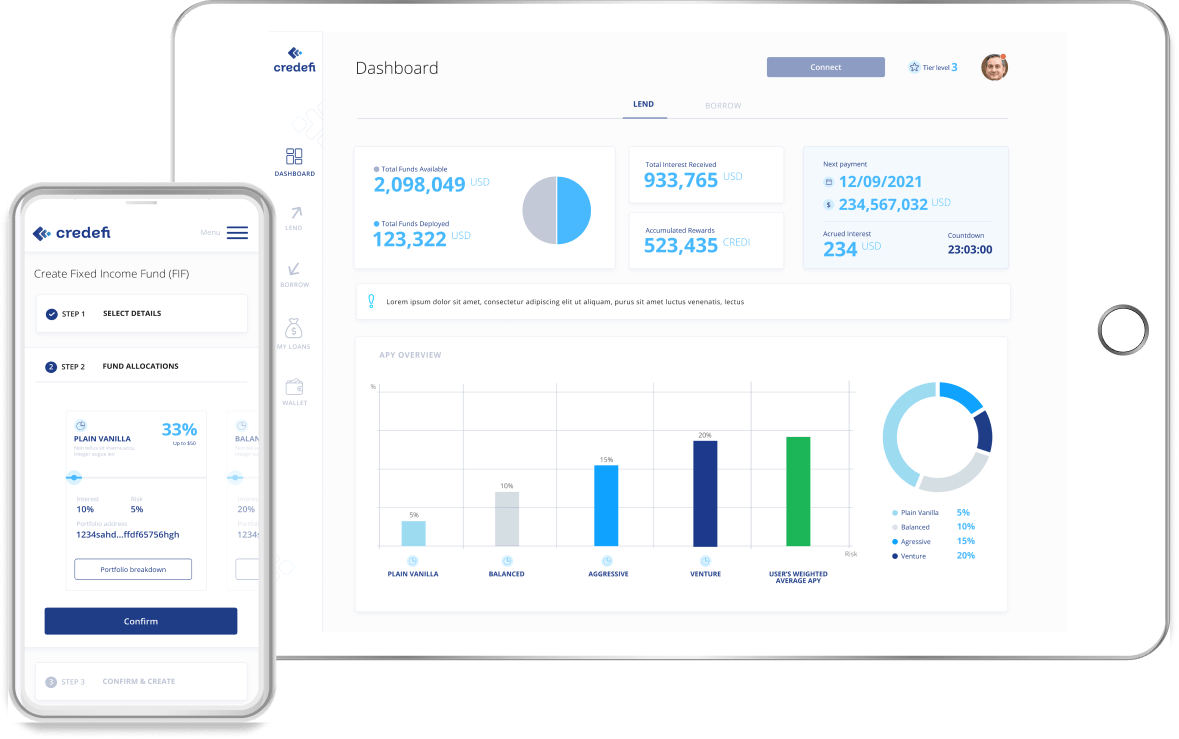

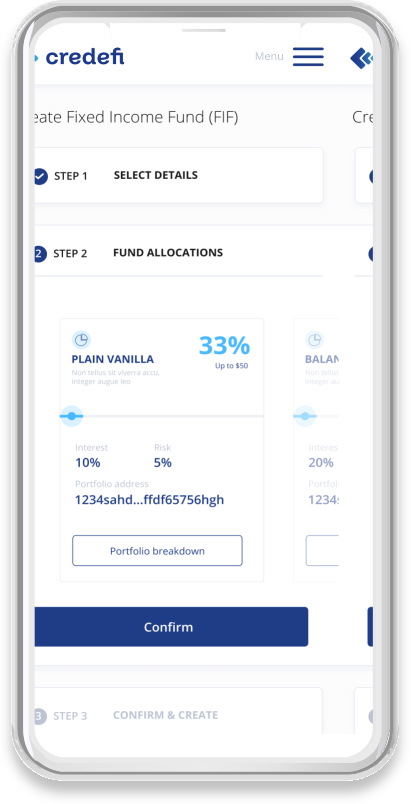

Portfolio Lending

Platform participants can lend stable coins to credit portfolios with risk profiles ranging from low to high risk. The platform will provide risk assessment and credit score data to lenders so they can take an informed investment decision. The credit portfolios will achieve APYs of 10% and higher depending on the risk appetite of the user.

Investment

Period of investment

Risk range

Total

0

Interest rate

0

Monthly repayment

0

Project-based P2P lending

Credefi will take full advantage of the decentralized finance capabilities of the blockchain, with direct peer-2-peer finance, liberalizing the process of lending and borrowing by connecting the willing parties worldwide. In addition to the collateralized loans, Credefi platform will be able to provide zero-collateral loans on a case-by-case basis.

Trade finance

Credefi is aimed to combine traditional banking instruments with the aspect of decentralization, offering the full length of services to its customers. Credefi will introduce trade finance to its offered services. Lenders and borrowers will be able not only to meet in a deal but also to underwrite a Letter of Credit or a Letter of Guarantee, as well as factoring services.

Why Credefi

Expertise

Our team is composed of international experts with strong management, financial and technical background.

Real-world Asset Collaterals

Our strategic partnership with an EU-accredited financial institution enables us to utilize Real-world Collateral easing the life of business borrowers.

High APY

We don’t do arbitrage between the lenders’ and the borrower’s agreed interest. The lenders are entitled to the entire interest of the facilities they finance.

Fair Deals

We perform credit risk analysis on every application on our platform. We adjust our rating to the actual data. We help lenders and borrowers find the right balance.

Security

We will implement 3-layer security for our platform lenders. It combines an in-house proprietary credit scoring, crypto and real-economy. assets collateral, and Credefi’s security module(Module X).

Decentralization

Credefi will implement a decentralized governance and operation model via our governance token xCredi and gradually increase community involvement in the lending process.

Why Credefi

Open your account and start earning APY on your stable coins.

Start HereAdvisors

Executive team

Ivo Grigorov

CEO & Founder

Ivo is an experienced Finance Specialist with a demonstrated history of working in the banking industry. He was extensively involved in the development and design of diverse financial instruments in both debt and equity segment. His skillset includes expertise in Market and Credit Risk, Capital Adequacy, and Management. As a strong banking and finance professional with a Master of Science (MSc) focused in Global Banking and Finance from European Business School (EBS) – London, he has proven track record on successful implementation of financial products. Ivo is in the blockchain and crypto market since early 2016 and a firm believer of its future applications.

Valentin Dimitrov

COO & Founder

Valentin is a Co-Founder of Credefi and has a vast and diverse background in both the financial and technology sector. He gained his experience through his work for European Parliament (ECON committee), VTB Capital and a Fund Manager of Financial Instruments in Bulgaria with more than 600 million euro under its management. As an early adopter of bitcoin and Ethereum since 2013 while completing his degree in Bocconi University, and a technology enthusiast who has expertise in Cybersecurity matters, Valentin is a major asset of Credefi team.

Lyubomir Blagov

CTO

Lyubomir has more than 10 years of experience in the technology sector. He has worked on multiple international projects with millions of daily users. Lyubomir possesses vast knowledge in established technologies and is always fascinated with the new ones, such as Blockchain. In addition, he founded a company that focuses on Ethereum and has already developed several successful projects. As a skilled professional, Lyubomir will be able to make the whole project become a reality and is therefore an integral part of Credefi team.

Our backers

Partners

News

Read our latest media coverage

SupraOracles is looking forward to strengthening Credefi’s capabilities through our oracle technology and evolving partnership. Solutions that allow DeFi to integrate with traditional finance are still very much in their infancy, and SupraOracles is thrilled to be working with a partner that understands this market as well.

SupraOracles is looking forward to strengthening Credefi’s capabilities through our oracle technology and evolving partnership. Solutions that allow DeFi to integrate with traditional finance are still very much in their infancy, and SupraOracles is thrilled to be working with a partner that understands this market as well.

Hedge yourself against crypto market volatility and earn stable APY in all market conditions.

Start Here